Infinity Money Glitch, using Options?

Exploring a ‘Zero-Risk’ SPY Strategy That Sounds Too Good to Be True

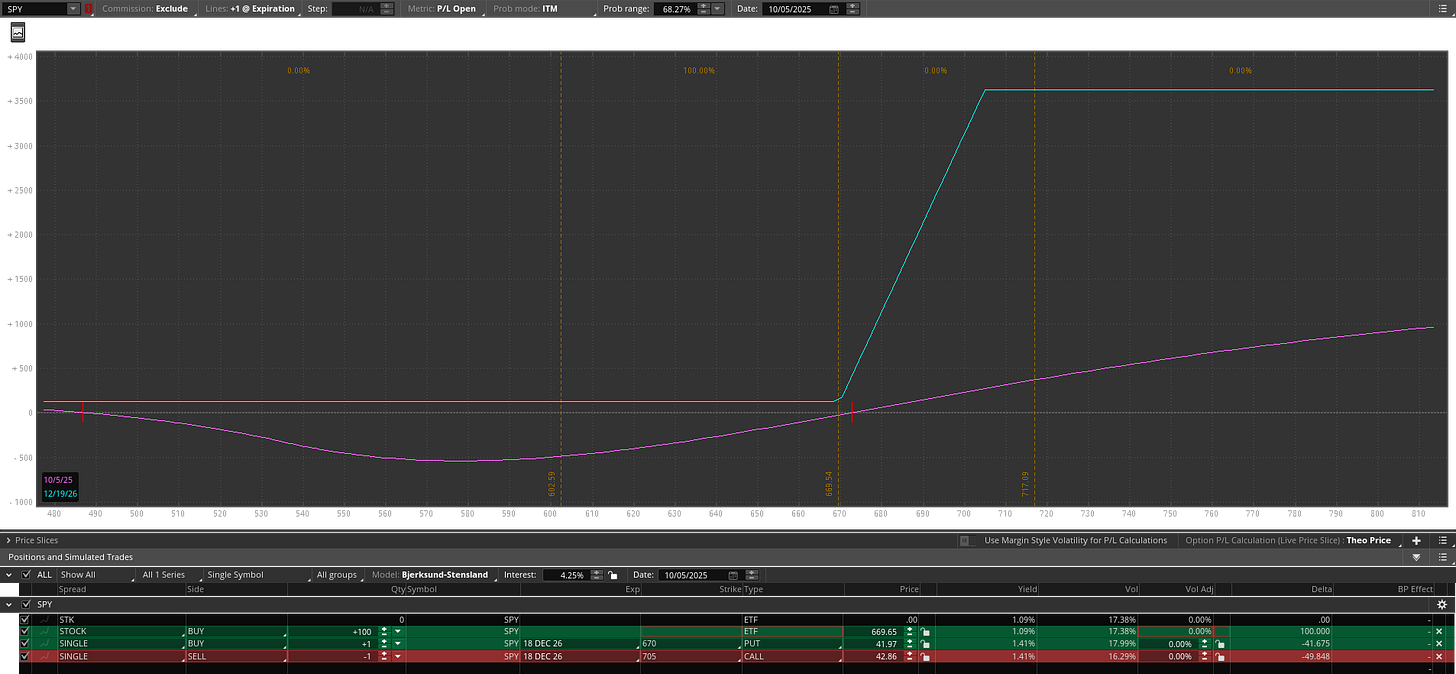

A friend recently asked me about a “zero risk” SPY 0.00%↑ strategy that looked too good to be true. Here’s the setup they shared:

Buy 100 SPY shares @ $669.65

Buy 1 SPY 100 DEC 18 2026 670 PUT @ $41.97

Sell 1 SPY 100 DEC 18 2026 705 CALL @ $42.86

At first glance, it seems like you can lock in a profit no matter what happens. But is it really risk-free? Let’s break it down.

What This Strategy Does

This is essentially a collar — a combo of:

Long stock → you own 100 SPY 0.00%↑ shares

Long put → sets a “floor,” so you can’t lose much

Short call → caps your upside, but you collect premium

In plain English:

You buy the stock, buy insurance against it dropping, and agree to sell it at a higher price if it soars. - SO WHAT? I make profits eitherway….. not so easy….

Cash Outlay:

Stock: 100 × $669.65 = $66,965

Put: 1 × 100 × $41.97 = $4,197

Call sold: 1 × 100 × $42.86 = $4,286

Net investment: $66,876

Profit/Loss Scenarios:

≤ $670 ——— Put protects → slight profit ~$124 (~1.85%)

$670 – $705 ——— Profit grows linearly with SPY price

≥ $705 ——— Shares called away → profit capped ~$3,624 (~5.42%)

We will look at this deeper on managing this situation.

On paper, it looks nearly risk-free, because in any direction you have no loss. BUT……

Caution Words

Liquidity / execution risk: Those long-dated SPY LEAPS often have wide bid/ask spreads. You might not get the perfect fill, ending up a small loss on the ≤ $670 situation.

Early assignment: Rare, but a short call could get assigned, meaning the broker can close your trade, leaving your put exposed.

Opportunity cost: Tying $66k to make ~$3.6k over 1.5 years (duration of the option) ~2.7% annualized — not exactly thrilling.

Taxes / dividends: LEAPS and covered calls have special tax treatments.

In short: “zero risk” is mostly theoretical. Real-world markets, fees, and spreads sneak in subtle risks.

Now, What Happens in a Strong SPY Rally

Here’s where it gets interesting. Suppose SPY rallies past your 705 sold call after 3 months (instead of 1.5 years):

Your short call is now in the money.

If you don’t roll it, your stock gains above 705 are capped, and most likely SPY shares could be called away.

If you roll the call to a higher strike (e.g., 730 or 740), you have to pay more to buy back the ITM call. (Essentially from gains on Long SPY position.)

If you roll the put to maintain a floor, it costs extra premium. Because your original 670 Puts lost value.

Net effect:

Gains from your SPY long above 705 are partially eaten up by the cost of rolling calls and puts.

Sold Calls increased in value (loss)

Bought Puts decreased in value (loss)

Bought SPY increased in value (gain)

Rolling repeatedly in a rallying market can create a major drag on profits, reducing the efficiency of your long stock position.

In short: collars protect downside but cap upside, and rolling in a strong uptrend can erode gains — making the “zero-risk” label less real.

The Compounding Angle

Here’s the exciting part. Suppose SPY rallies to your short call strike (705) in just 3 months:

You can theoretically close the trade for ~5.42% profit in 3 months

Annualized, that’s roughly 23.7%, if you repeat the process every quarter

Considering the market rallies every quarter.

With disciplined rolling, a series of collars can compound returns significantly, even though each individual trade has capped upside.

Can You Expand Profits by Rolling?

Yes, you can “roll” options:

Rolling calls: Buy back the old call → sell a higher strike or later expiry.

Rolling puts: Adjust your floor (up for more protection, down to save cost).

But:

In strong rallies, it reduces your SPY profits.

Also, you have virtually no risk.

Great!, but the Caveat?

One subtle but important reality: when SPY rallies past your sold call, rolling the options to maintain the collar requires additional capital. While this reduces your stock gain, it keeps the “money made with little risk” engine running.

In other words, compounding these risk-protected gains isn’t free — you need cash ready to reset the strategy.

Conclusion

This is a collar strategy: protects against big losses, caps big gains.

Rolling can extend profits, but in a strong rally, it drags on your long stock gains. (or requires additional managing capital)

If SPY rallies strongly, your stock gains are partially eaten by the cost of closing ITM calls and adjusting puts.

At UCS Framework we backtest everything, stay tuned…….

Scenarios to be back tested – Moderate Rally, Strong Rally, Flat / Sideways, Sharp Decline, Volatile Swings.