Know Who You Are: Trader or Analyst?

Aligning "your" market psychology early can save years of frustration.

I often see people question the credibility of a system — or a seasoned trader — after a few wrong calls.

I’ve been there too. When I started, I thought a few wrong trades meant the method was broken, or worse, that I was.

But as I matured in trading, I realized something simple yet profound:

In finance, “being right” means very different things depending on who you are.

And if you stay with this thought till the end — you’ll have clarity about where you fit.

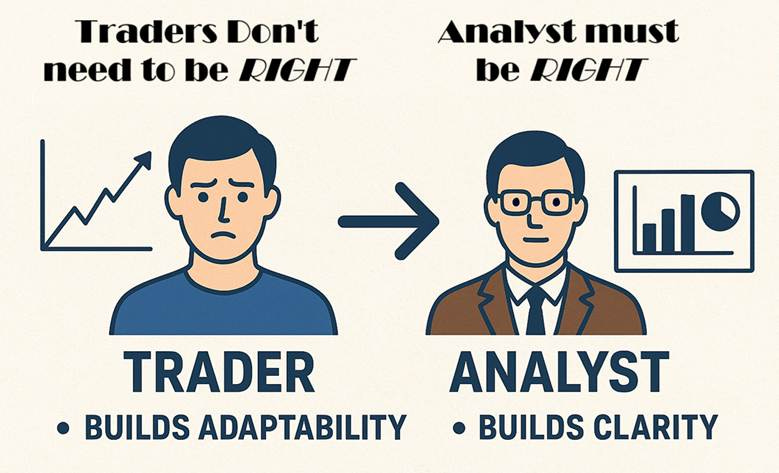

An analyst - someone who builds conviction.

They live in a world of valuation models, industry insights, and carefully reasoned theses.

Their job is to be right in principle — to explain why something should happen.

Accuracy is their currency.

A trader, on the other hand, survives in a world of uncertainty.

They don’t get paid for being right — they get paid for responding right.

Their job is to manage emotion when logic fails — and yes, they will fail often.

That’s the paradox:

The analyst seeks clarity.

The trader accepts ambiguity.

Psychologically, an analyst finds comfort in structure — in research, evidence, and neat conclusions.

A trader finds comfort in chaos — in knowing that being wrong isn’t failure, it’s feedback.

An analyst needs confidence to publish.

A trader needs humility to persist.

That’s why some of the best traders I’ve met — and become friends with — are recovering perfectionists.

They learned to detach their ego from their opinion.

To say, “I was wrong,” without losing their identity.

Meanwhile, an analyst’s strength is conviction — without it, their work dissolves into noise.

One seeks to understand the market. The other seeks to survive it.

Both are essential to the market’s ecosystem.

But confusing your market psycology as one for the other can be very expensive.

So, learn who you are early — it will steer your wealth-building journey in the right direction.

If you’re the kind of person who:

Needs to “understand everything” before acting,

Spends hours hunting for the perfect indicator or entry,

Feels emotional discomfort when a trade goes red,

Avoids taking losses because “it might bounce back,”

Then your natural psychology leans more toward analysis and conviction.

That’s not a flaw — it’s a compass.

You may thrive in long-term investing, where conviction compounds and short-term volatility is just noise.

But if you:

Can act on incomplete information,

Accept losses quickly and move on,

Feel calm when others panic —

Then, you might be wired for the uncertain, imperfect, and deeply human game of trading itself.

And value adaptability over being right —

then you’re wired for trading.

Trading is a psychological sport, not a prediction contest.

You don’t have to be right — you just have to last.

But lasting requires self-awareness.

Knowing who you are in the market is more valuable than knowing where the market goes next.

So, before you open the next chart, ask:

“Am I seeking clarity, or am I seeking control?”

The answer determines whether you should be managing trades… or managing portfolios.