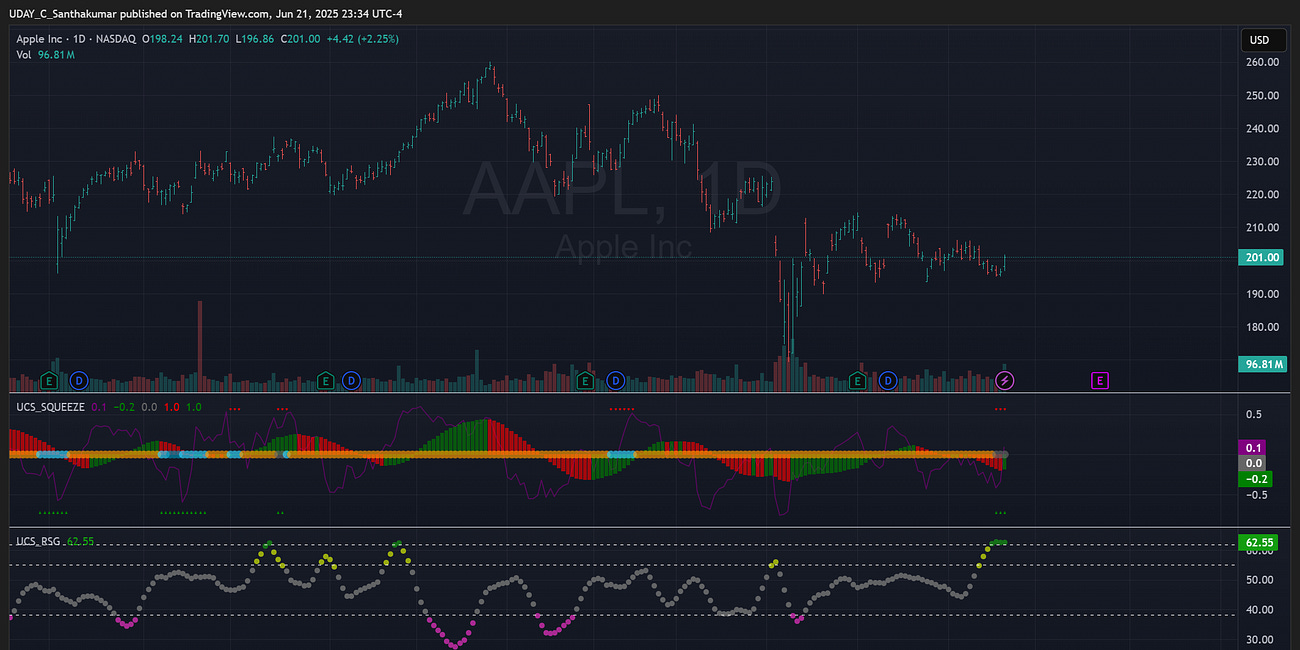

UCS Framework #4 in Action

Flexibility & Grit in My AAPL Iron Condor Comeback

On June 23rd, I shared my trade idea with the community — an unbalanced long iron condor on AAPL, set to expire 40-50 days.

When you post your trades publicly, the stakes feel different. You’re not just betting money — you’re betting your credibility. If it works, great. If it doesn’t… well, you’d better have a lesson to share. Here is a lesson.

The Setup

The chart was coiling tighter than a jar lid after arm day — volatility squeeze in full swing. Earnings were coming, implied volatility was heating up but not yet maxed.

My thesis was simple:

Run-up before earnings → close the short put side & long call spread early, leaving the long 195 put for the post-earnings drop.

Disappointing results → It never reached the Run-up theory levels pre earning.

The Trade: on July 27th.

BOT +1 IRON CONDOR AAPL 100 (Weeklys) 8 AUG 25 215/220/195/185 CALL/PUT @3.60

Call Side: Long 215C / Short 220C → $5 width

Put Side: Long 195P / Short 185P → $10 width

Debit Paid: $3.60 per contract

Potential:

Max Loss: $360 per contract

Max Profit on Call Side: $140

Max Profit on Put Side: $640

Weighted for the downside — because that’s where I saw the money, looking at the IV levels of individual options.

Earnings Night – Uh-oh

Earnings dropped… and AAPL gave back the pre-earnings rally, landing smack in the center of my iron condor. (i.e. max loss)

Publicly.

That’s the kind of moment where traders start mentally composing their “well, you can’t win them all” post. But I wasn’t ready to write that one yet.

The Pivot

I closed both short legs for almost nothing ($0.05 each). That booked a small credit and left me holding only the long 215 calls and long 195 puts — both OTM, both still alive.

It was now a $360 lottery ticket with a week left to play out.

The Twist

By August 7th, AAPL had drifted up to 220. Those long calls I’d written off suddenly woke up. I closed them for a net $110 profit, per contract.

Sure — if I’d held just one more day, the position would have been worth about $3,000. But trading isn’t about what could have been. It’s about making consistent, rational decisions in the moment.

Why This Trade Mattered

Transparency matters. If you post your trades publicly, you have to own them — good or bad. (Recall PEP trade, I had to admit that was a loser.)

Adaptation beats prediction. My original thesis failed, but adjusting on the fly still produced a win.

Mindset is everything. Regret is the easy road. Being okay with the decision you made at the time — that’s the skill.

This wasn’t just about salvaging a “max loss” setup. It was about showing that even in public, even when the market laughs at your plan, you can keep your head, work the position, and still walk away with profit.

Backtest - Because Talk Is Cheap

I get it — talk is cheap, and nobody should just take my word for it. You should be interested in proof, data, numbers.

The AAPL iron condor trade wasn’t just a gut call or a lucky guess — it fit a pattern that’s repeated itself in various forms across different market regimes. The squeeze before earnings, the volatility run-up, the skew in option premiums — all of these factors showed consistent edge in backtesting.

So if you’re skeptical (and you should be), don’t just listen to me — put the framework to the test yourself. Re-create the trade and make decisions day by day.

Because the difference between a hobbyist and a pro trader? Discipline and data-backed confidence.