TICKER 1 — AAPL 0.00%↑

Setup: UCS#4 — Ultimate Squeeze Setup

We're in a confirmed Ultimate Squeeze – Level 1, with daily resistance holding firm. This setup is the kind you wait weeks for — a breakout in the next 30 days could be the real prize.

That said, it’s AAPL 0.00%↑ — and I’ll admit, I carry a slight bullish bias here. But bias aside, the RSG (Ready-Set-Go) indicator is flashing SET, which means volatility expansion is imminent.

Strategy Insight

As outlined in my June 6 PEP 0.00%↑ setup, fake-outs in UCS#4 are not just possible — they’re brutal. They eat option premiums alive unless you enter with structure and discipline.

The GO phase typically arrives with a breakout or head-fake, often spiking IV. That’s why the SET phase — before the crowd rushes in — is the ideal time to build your positions.

My Plan

Timing: 40–50 DTE, expiry 1–2 weeks post-earnings

This window allows for adjustment and leg management as individual components hit profit zones.Primary Setup: Back Ratio Spread (Bullish)

For experienced traders. Works best if IV on the short leg > IV on the long leg, enhancing cost efficiency and reward skew.Alternative: Long Iron Condor

Better suited for beginners and intermediate traders wanting a bi-directional bet with defined risk.

AAPL options are extremely liquid — a patient limit order almost always gets filled near your mark.

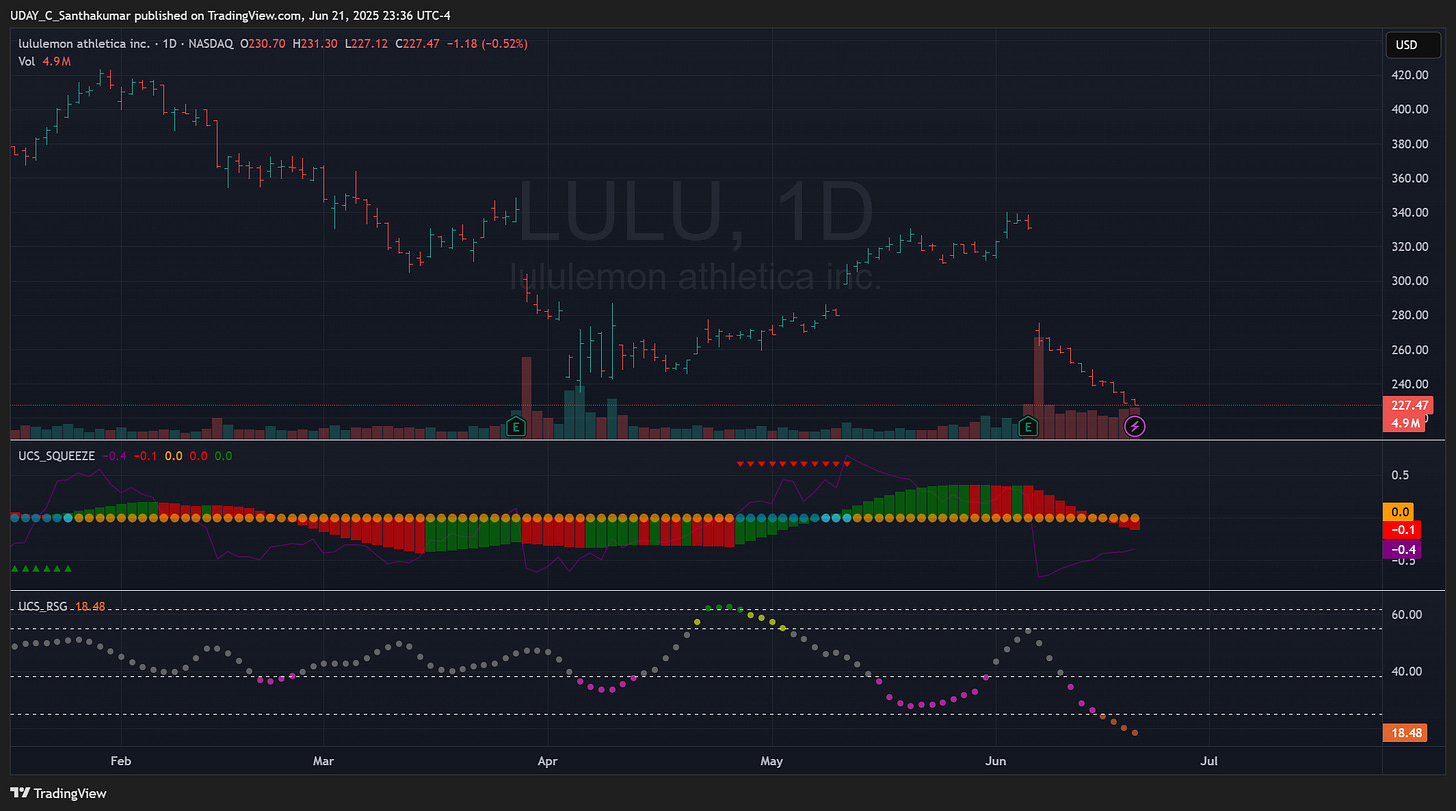

TICKER 2 — LULU 0.00%↑

Setup: UCS#3 — Deviation from Mean

Spotted this late (along with ORCL) on the extreme mean deviation scan — apologies for the delayed post by ~2 days. However, LULU 0.00%↑ can be considered.

Post-earnings negative sentiment has dragged LULU to a key support zone. Technically, a bounce is due — but timing matters.

The RSG indicator is reporting extreme market overreaction (values well below 20), which historically leads to short-term reversals.

Strategy Insight

Think $ETSY from June 7th - 1 week trip (in & out), but in reverse — we’re playing rebound on LULU 0.00%↑ , not a pullback like ETSY 0.00%↑ .

The catch? We’re post-earnings, which means IV has cooled — not ideal for premium selling.

My Plan

Setup: Long Call Spread (Debit Call Spread)

Triggered only after a bottoming pattern forms — watch the 30-minute chart or wait for a strong end-of-day candle.Delta Target: 65

Meaning, center your call spread as close to 65 delta as possible

DTE: 15-20 (modal number based on my backtesting)

TICKER 3 — MA 0.00%↑

Setup: UCS#2 — Extended Pullback

MA has pulled back cleanly into a well-defined support zone, aligning perfectly with the UCS#2: Extended Pullback playbook. This isn’t a bi-directional trade like AAPL — but it’s a high-conviction directional setup that pairs extremely well alongside binary-style option structures.

Why? Because this is one of those setups where you can define your risk tightly and aim for a 1:1 (or better) risk/reward — $5 to make $5 — based on a probable reversal. [Take a quick glance to left side of the chart, for the idea]

Strategy Insight

This structure works best when paired with a confirmation for bounce, either from a strong bounce candle on the daily or intraday 30-min chart showing change in momentum.

Setup: Long Call Spread (Debit)

Simple vertical spread, nothing fancy. Keep the strike spacing tight — you’re trading efficiency here, not chasing home runs.Delta Target: 50

Center your long call spread at or near 50 delta — this provides a balanced convexity while staying cost-efficient.DTE: 45 (30–60 acceptable based on timing and execution preference)

While this is not a binary options trade, it slots in well next to those setups — allowing for capital-efficient directional exposure with well-defined max risk and reward. Atleast in my opinion, I call it Binary Options for simplicity.

Disclaimer:

I am NOT a licensed financial advisor, investment professional, or registered broker-dealer. The strategies, indicators, and trade ideas shared here are for educational and informational purposes only. They reflect my personal opinions, research, and trading approach.

Trading options and financial markets involves risk. Please consult with a qualified financial advisor or conduct your own due diligence before making any investment decisions. Use of this information is at your own risk.

Eagerly waiting for AAPL earnings. Hope to recover the loss from PEP, otherwise back to origin. :)

Closing $MA & $LULU - booking the wins and moving on. $AAPL (struggling) & $PEP (Bad) performance. PEP is set to expire this week - looking like a loser.