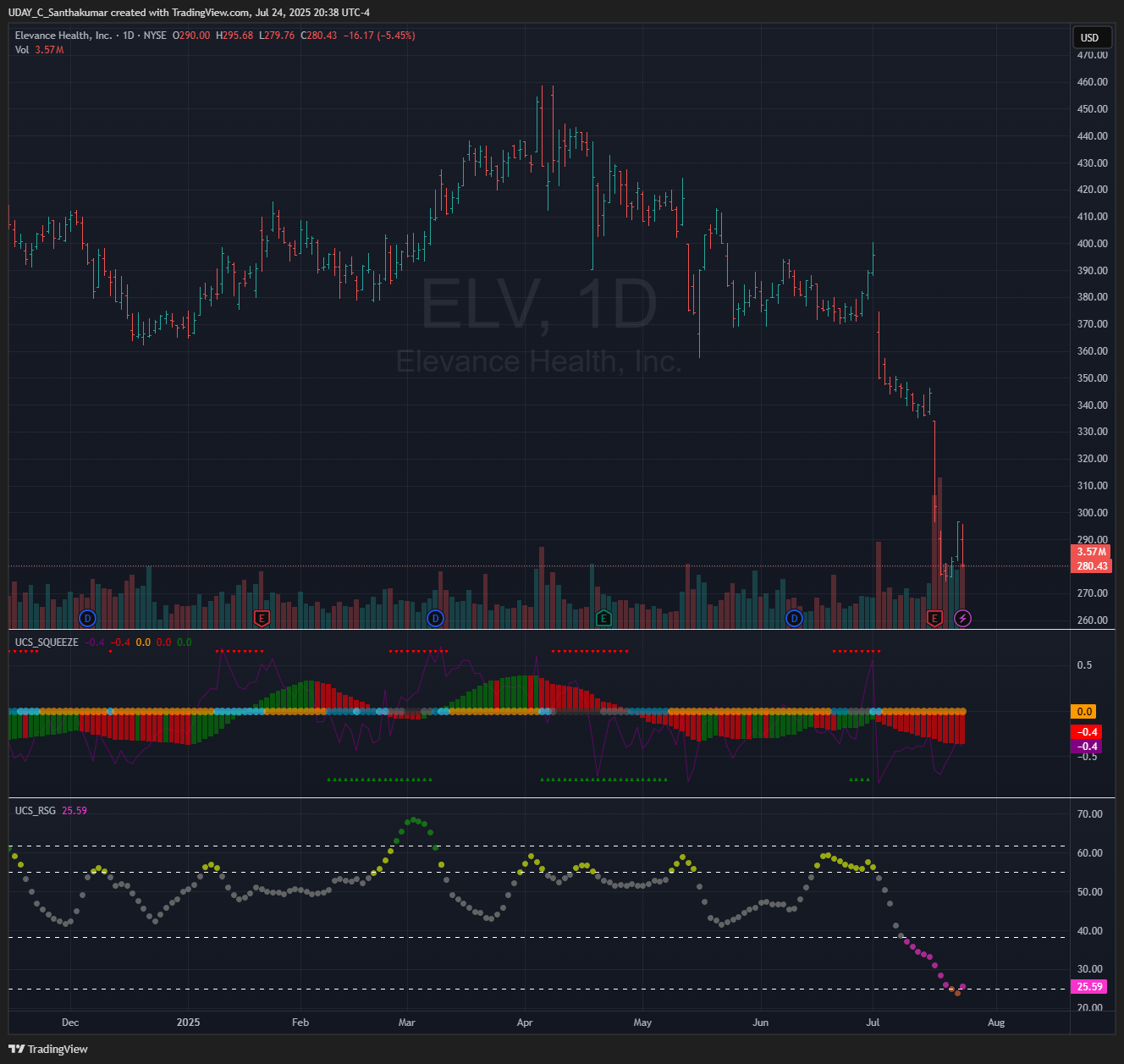

TICKER 1 — Elevance Health ELV 0.00%↑

Setup: UCS#3 — Deviation from Mean Setup

Setup Overview

Elevance Health ELV 0.00%↑ has pulled back sharply in reaction to its latest earnings — down ~11–12% intraday — landing near 45–50% below its 52-week highs. That makes this a classic UCS#3: Deviation from Mean scenario: the stock has dropped far beyond its historical average range.

We're now at a support-ish zone, with extreme mean deviation potentially offering a high-probability bounce window — watch if the price action begins to stabilize.

Recent Earnings Summary

(For your information, nothing to do with trade bias)

Financial Highlights (Q2 2025)

Adjusted EPS: $8.84 ⬇︎ vs. Wall Street’s $9.07 estimate (≈ –2.5%)

Revenue: $49.4B (+14% YoY), beat forecasts of ~$48.1B

Net income: $1.74B GAAP (~$7.72 EPS), down from $2.30B a year ago

Guidance & Macro Stress

Full‑year EPS guidance slashed to ≈ $30 (from prior $34.15–34.85 range) — a 13% downgrade, driven by rising medical cost trends in ACA and Medicaid lines

Benefit expense ratio surged to 88.9% (+260 bps YoY), compressing margin room despite revenue growth

Operating expense ratio improved slightly to ~10.0%, showing cost discipline but not enough to offset benefit-cost pressure

Stocks & Sentiment

ELV dropped ~11% post-earnings, marking its largest intra‑day move in over a year — highlighting how rare such volatility is for this large-cap insurer

Analyst sentiment remains cautiously positive, but BofA notably cut its price target to $350 (from $420) and flagged Medicaid/exchange shifts as structural headwinds

My Trade Plan (Trader-Focused)

Structure: Short Put Spread (Credit)

A modest directional bounce trade, with limited risk and controlled capital outlay.Delta Target: ~ 40 Delta — balanced convexity for a somewhat neutral directional thesis.

DTE: 18-ish - short runway.

Entry Triggers:

Technical signs of stabilization (e.g., higher-low on day chart, tightening range)

Volume tick up near support zone

Risk Management:

Risk capped at ~$6 per spread (e.g., $500 for single contract) aiming for $4 profit

If bounce fizzles or membership trends deteriorate further, I’m out early.

Plan B: If price slices through support aggressively, consider a breakout flip into an Iron Condor / Overlapped butterflys targeting short gamma.

Mental Edge Note

This setup is not about catching the bottom — but about risk-defined participation after a sharp, overextended sell-off. UCS#3 favors entries when markets overreact structurally. Our edge comes from calibrated exposure, not guesswork.

Disclaimer:

I am NOT a licensed financial advisor, investment professional, or registered broker-dealer. The strategies, indicators, and trade ideas shared here are for educational and informational purposes only. They reflect my personal opinions, research, and trading approach.Trading options and financial markets involves risk. Please consult with a qualified financial advisor or conduct your own due diligence before making any investment decisions. Use of this information is at your own risk.

ELV - closed for 87% of potential gain. The word 'potential gain' = Credit options - i.e., took 87% of credit.